But when you are a $100-billion business – with over 170 products – that provides investors with peace of mind, because we have a lot of assets in those products.” “Liquidity was a big factor for investment advisers and probably continues to be more of a factor right now with where markets are. “When we had the ETF business on our own – before the alliance – the thing we were always challenged with was liquidity,” Mr. RBC entered the market in 2011 in order to catch up, it needed a partner. As investor demand forced the banks to take notice, larger global asset managers such as BlackRock and the Vanguard group were already industry leaders in the Canadian ETF market, with product lineups that largely consisted of low-cost index-tracking funds.

When ETFs first launched in Canada in the late 1990s, there were fewer than a handful of independent providers in the market. “There is no time stamp on the agreement, but if we were to go separate ways, all of a sudden we don’t have a product shelf and BlackRock doesn’t have distribution.” “It’s been three years, and we hope to be together three decades from now,” said Doug Coulter, the president of RBC Global Asset Management, in an interview. While there has been some consolidation in the industry, there has never been a similar alliance or partnership between competitors. Today, there are 42 ETF providers in Canada, managing a total of $304-billion in assets, according to research by National Bank Financial. RBC iShares is Canada’s leading ETF company, with almost $100-billion in assets in more than 170 ETFs – up from $60-billion in 120 ETFs when they joined forces in 2019. In 2019, BlackRock needed a path to a larger distribution network, while RBC was lagging behind competitor Bank of Montreal BMO-T in overall ETF assets.Įxecutives at both companies stress that RBC iShares is not a joint venture or legal partnership, but rather an arrangement that allows the two asset managers to remain separate legal entities while operating a co-branded ETF business. The alliance between Canada’s largest bank and the world’s largest money manager is rare in the asset management business. Why big investors aren’t giving up on ESG Now, the message about how fixed income fits into a portfolio is one of the biggest conversations we are having right now.” “As soon as we saw that 50-basis-point rate hike in April, we started to see the flows shift. Hayes told The Globe and Mail in an interview.

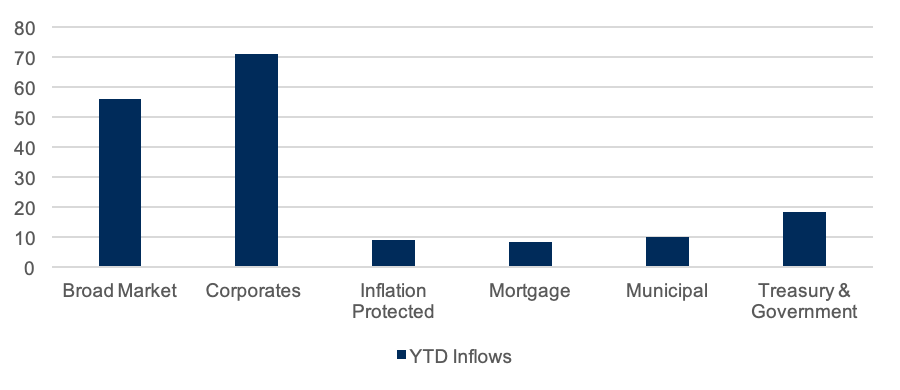

“We have seen investors turning much more defensive in recent months, moving from equities to fixed income,” Ms.

0 kommentar(er)

0 kommentar(er)